Austin Flooding: What to Know Before You Buy an Austin Home

Posted by Brad Pauly on Tuesday, September 17th, 2019 at 9:10am.

Before moving to Austin from another city, you've probably been told of some of the downsides. Our traffic has gotten pretty bad, summers are hot, and allergies can be tough. A lesser-known concern to be aware of is Austin flooding. Central Texas is such a flash flood-prone region that the National Weather Service sometimes refers to our area as “Flash Flood Alley.”

However, you needn't be too worried. Flash floods are generally most dangerous when driving, not at home. In fact, 75 percent of Texas flooding deaths occur in vehicles. Make sure to stay off the road when flash floods are predicted.

As far as real estate is concerned with Austin flooding, the majority of localized flooding doesn't exceed a few road closures in your neighborhood. You shouldn't expect torrential downpours requiring you to ax through your attic. Still, you should take into account Austin's floodplain map and Austin's flooding history before buying a home. Keep reading to learn everything you need to know about Austin flooding before you buy a home.

Austin Flooding History: What to Know About Floodplains in Austin

Depending on how much Texas rain there has been, Austin’s creeks may be bone dry, gently flowing, or raging torrents. The floodplain is the area of land that is likely to be underwater when the creek rushes over its banks. In a sense, the floodplain is the full extension of the creek.

Water levels in Austin will vary greatly depending on the time of year and relative Texas rainfall. Just because a creek is bone-dry when you buy a house, does not mean that it won’t flood in 6 months or a few years. You can use this helpful interactive Austin flood map to find out more floodplain information for every Austin neighborhood: http://www.austintexas.gov/FloodPro/

What is a 100-year floodplain?

The 100-year floodplain is the land that is predicted to flood during a 100-year storm, which has a 1% chance of occurring in any given year. You may also hear the 100-year floodplain called the 1% annual chance floodplain or base flood. Areas within the 100-year floodplain may flood in much smaller storms as well. The 100-year floodplain is used by FEMA to administer the federal flood insurance program and the City of Austin to regulate development.

Areas in a 100-year floodplain have a one percent chance or greater of flooding each year.

A 100-year floodplain means that there is a 1% chance of flooding, every year, during a “100-year storm”. However, there are often areas inside of those 100-year zones that could flood during smaller storms. It is important to remember that FEMA uses the 100-year floodplain to administer the federal flood insurance program. The City of Austin also uses this model to regulate development.

If a residence is in the 100-year floodplain, there is roughly a 30% chance of flooding during a 30-year mortgage.

On top of all this, intense rains have been increasing and likely to continue increasing. Austin rain previously classified as 100-year events are now 25-year events. To combat this, Austin county officials spend millions on studying how to reduce flood damage and implementing flood safety measures and flood mitigation projects.

How do I know if a home is on a floodplain?

Floodplains are usually found near a body of water. This could be anything from a major lake to a small creek. When looking for a home in Austin, it’s important to keep in mind that there are a large number of natural and artificial bodies of water, often adjacent to residential properties. These areas often make for great views, but Austin house hunters need to be aware of flooding history and potential dangers before making an investment. As Austin's population increases, so do localized flooding problems. More impervious cover being paved results in more runoff.

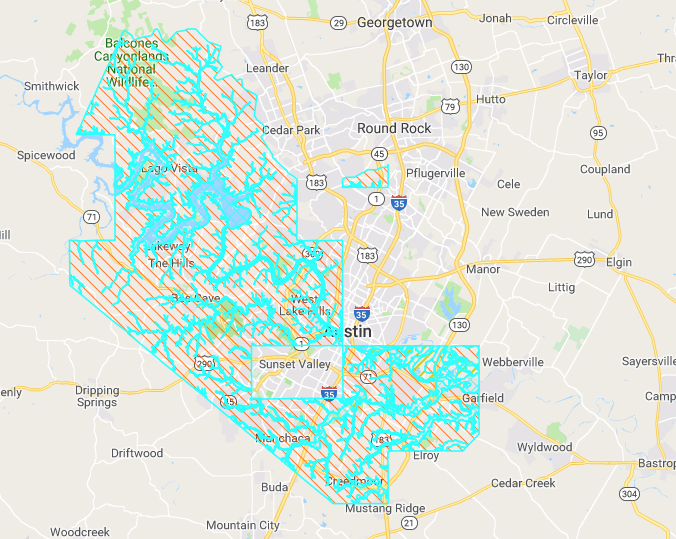

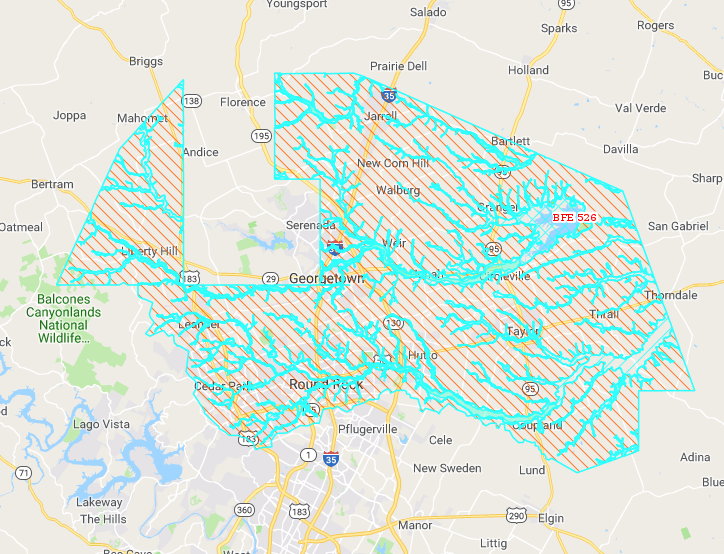

Austin Flood Map - Courtesy of FEMA

What you can watch for when viewing a home

Don’t just look inside the house. Look around the yard and even through the neighborhood. You can evaluate things like water features, drainage systems, and retention basins in the area. For instance, if it hasn’t rained recently and the retention basin is full, there could be issues with drainage. Some neighborhoods have massive retention basins, which could be a sign that the area has flooding issues or that the developer overplanned for future Austin flooding. Your agent can help you tell the difference and make an educated decision.

Always be cognizant of the interior of the home. Things like partial new carpeting or paint, especially near ground level, can be clues that there was previous water damage. If you suspect that the seller has not been forthcoming, your agent can often help you find information on previous Austin flooding reports and claims.

Is it difficult to sell a home in an Austin flooding zone?

One reason that homebuyers may be reluctant to purchase a home in a flood zone is the potential difficulty in reselling. A house being in a flood zone is always going to be a concern for homebuyers, which is why you need to do your research before buying a home in a floodplain. Homes in neighborhoods like South Lamar, Brentwood, and Hyde Park experience flooding frequently. If a home has flooded multiple times already, then there is a good chance it could continue to flood, assuming that the drainage infrastructure remains the same.

Updates to drainage systems and retention ponds should be considered when looking at historical flooding data. With so many Austin homes in or near floodplains, most homebuyers understand the inherent risks, which is why you will want to able to prove that the home is a safe investment despite being in a floodplain. Luckily, your agent will be knowledgeable on the subject and will be able to help you decide on what constitutes a risk and how that factors into cost and potential resale value.

Will I need flood insurance?

If you do decide to purchase a home in a floodplain or flood zone, flood insurance can be crucial to protecting your home and belongings. While flood insurance isn’t mandatory in Texas, most mortgage lenders will require some form of coverage when buying a home in flood zones.

According to The City of Austin, residents outside of floodplain areas file more than 20% of flood insurance claims and receive about one-third of disaster assistance when it is available. Also, be aware that general homeowners insurance policies do not cover the flooding caused by stormwater. Keep this in mind when considering your budget and mortgage. You can consult with your agent to gauge the potential risks and discuss what kinds of flood insurance maybe be best for your situation.

If you would like to learn more about floodplains, how they can affect your home or flood insurance questions, please contact Pauly Presley Realty today.

Wondering what else you should know before you buy an Austin home?

Check out our Austin home buyer's guide to learn everything you need to know!